Creating World-Class Destinations

& Sales

Services

-

Commercial

-

Residential

-

Retail

-

Logistics

-

Hotels

-

Golf clubs

-

Leisure

-

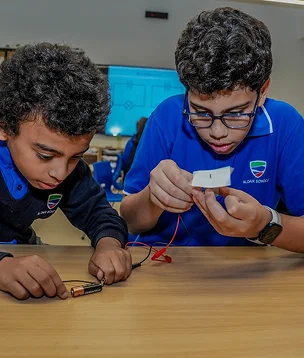

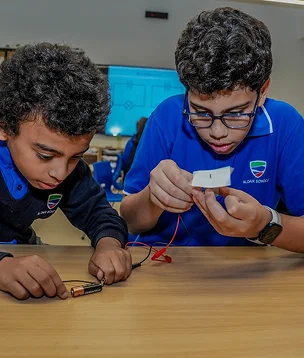

Owned and operated schools

-

Managed schools

-

Property management

-

Facilities management

-

Integrated community services

-

Valuation and advisory

-

Private credit

-

Co-working

-

Other investments

Aldar’s develop-to-hold (D-HOLD) strategy bridges its two core businesses, leveraging expertise in development and active asset management to generate attractive returns and long-term capital appreciation. Aldar has a significant D-HOLD pipeline across commercial, residential, retail, logistics, hospitality and education.

Earlsfield, London (London Square).

Verdes by Haven, Dubai.

Ogami, Ras El Hekma, Egypt.

Mamsha Palm Residences, Saadiyat Island, Abu Dhabi.

Twickenham Green & Twickenham Square, London (London Square).

Mandarin Oriental Residences, Saadiyat Island, Abu Dhabi.

Faya Al Saadiyat, Saadiyat Island, Abu Dhabi.

Westminster Tower, London (London Square).

Announced plans to develop and launch an iconic Grade A office tower development on Sheikh Zayed Road, beside DIFC, which will also include a luxury boutique hotel and branded residences.

Focused expansion within UAE and internationally

Aldar plays an integral role in shaping Abu Dhabi’s economic

landscape as the market’s dominant real estate player, and continues to capitalise on its

longstanding track record, expertise and sizeable landbank to create thriving integrated

communities in some of the most sought-after destinations across the UAE.

Pursuing a

strategy to diversify geographically and across asset classes, Aldar has expanded beyond Abu

Dhabi to the Emirates of Dubai and Ras Al Khaimah. The company is successfully leveraging its

franchise, capabilities in master-planned communities, and strengths as an active asset

manager of a growing investment property portfolio.

Leveraging an efficient operating model designed to deliver sustainable growth, Aldar has taken concrete steps to expand its footprint internationally, principally through acquisitions of ambitious, like-minded residential developers in the United Kingdom and Egypt, as well as through private credit opportunities in Europe.

Iconic venues, integrated lifestyles

Shaping a modern, luxury lifestyle destination

Aldar has been a key driver of Saadiyat Island’s rapid development as a world-class destination since its 2018 acquisition of land from the Tourism Development & Investment Company and a 2019 land swap with the Government of Abu Dhabi. The company continues to capitalise on strong demand for luxury residential through a series of landmark development launches, including hospitality and luxury residence partnerships with premium lifestyle operators, such as Nobu and Mandarin Oriental.

In line with its community-first approach, Aldar is also developing a high-end retail offering at the heart of the Saadiyat Grove development and progressing plans for a business park. To cater for the island’s strong appeal to families, Aldar has ensured access to high quality education is within easy reach, establishing two campuses of Cranleigh Abu Dhabi to cater to a growing population.

-

Mamsha Gardens

-

The Arthouse

-

Nouran Living

-

Manarat Living II

-

The Source Terraces

-

Faya Al Saadiyat

-

Mamsha Palm

-

Mandarin Oriental Residences

Striking a work-life balance

Since Aldar led the creation of a thriving leisure destination on Yas Island over a decade ago, the company has continued to be at the forefront of the island’s rapid growth and development. As a stand-out example of integrated master-planning, Aldar has established its flagship Abu Dhabi retail asset, Yas Mall, at the heart of the community, while introducing a blend of apartment and villa developments across the island and providing a range of education facilities including the Noya British School. The focus now is to transform the island’s hospitality landscape to provide a luxury resort offering and to create commercial assets to activate the island as a business hub.

-

Sama Yas

-

Yas Riva

At the forefront of Abu Dhabi’s growth as a financial hub

Aldar has become a driving force in the success of the financial district since the acquisition of the four ADGM commercial towers and the Al Maryah Tower in 2022. Through active asset management, including the introduction of pre-leasing for the first time in Abu Dhabi, these Grade A assets are at near full occupancy.

In the context of strong demand for prime office space from blue-chip tenants, Aldar continues to expand its footprint to bring further supply to the market, while also advancing plans to take a stake in the Galleria Luxury Collection retail asset through a joint venture with Mubadala that is scheduled to complete in 2025. A rigorous focus on premium spaces and plans to further develop the island’s commercial offerings will ensure Al Maryah Island remains the destination of choice for firms aiming to expand their presence in a country and region positioned for exceptional growth.

Growing footprint for a successful franchise

Aldar has successfully expanded its footprint into Dubai, focusing on the major themes defining the Emirate’s economic success – growth of the financial services sector, trade and commerce, and an expanding population. Through a blend of development joint ventures, acquisitions, and its develop-to-hold strategy, the company is increasing exposure across the residential, commercial, retail and logistics asset classes. Key initiatives include the strategic joint venture with Dubai Holding to develop three master-planned communities, a logistics partnership with DP World and the acquisition of an office tower to be built in the Dubai International Financial Centre (DIFC); positioning Aldar as the only company that owns commercial assets onshore in Abu Dhabi and Dubai, as well as offshore in the financial centres of both Emirates – ADGM and DIFC.

-

Verdes by Haven

-

Athlon

Positioned for rapid growth in tourism

Ras Al Khaimah continues to play a key role in Aldar’s geographic diversification strategy. To capitalise on the Emirate’s rising prominence as a tourism and recreation hub, the company has redeveloped Al Hamra Mall, positioning it as a premier retail destination, while acquiring and investing in the upgrade of the key hospitality assets of Rixos Bab Al Bahr and DoubleTree by Hilton Resort & Spa Marjan Island. Bringing a new luxury lifestyle offering to the market, Aldar is developing branded residences in collaboration with Nikki Beach.

Shaping a modern, luxury lifestyle destination

Aldar has been a key driver of Saadiyat Island’s rapid development as a world-class destination since its 2018 acquisition of land from the Tourism Development & Investment Company and a 2019 land swap with the Government of Abu Dhabi. The company continues to capitalise on strong demand for luxury residential through a series of landmark development launches, including hospitality and luxury residence partnerships with premium lifestyle operators, such as Nobu and Mandarin Oriental.

In line with its community-first approach, Aldar is also developing a high-end retail offering at the heart of the Saadiyat Grove development and progressing plans for a business park. To cater for the island’s strong appeal to families, Aldar has ensured access to high quality education is within easy reach, establishing two campuses of Cranleigh Abu Dhabi to cater to a growing population.

-

Mamsha Gardens

-

The Arthouse

-

Nouran Living

-

Manarat Living II

-

The Source Terraces

-

Faya Al Saadiyat

-

Mamsha Palm

-

Mandarin Oriental Residences

Striking a work-life balance

Since Aldar led the creation of a thriving leisure destination on Yas Island over a decade ago, the company has continued to be at the forefront of the island’s rapid growth and development. As a stand-out example of integrated master-planning, Aldar has established its flagship Abu Dhabi retail asset, Yas Mall, at the heart of the community, while introducing a blend of apartment and villa developments across the island and providing a range of education facilities including the Noya British School. The focus now is to transform the island’s hospitality landscape to provide a luxury resort offering and to create commercial assets to activate the island as a business hub.

-

Sama Yas

-

Yas Riva

At the forefront of Abu Dhabi’s growth as a financial hub

Aldar has become a driving force in the success of the financial district since the acquisition of the four ADGM commercial towers and the Al Maryah Tower in 2022. Through active asset management, including the introduction of pre-leasing for the first time in Abu Dhabi, these Grade A assets are at near full occupancy.

In the context of strong demand for prime office space from blue-chip tenants, Aldar continues to expand its footprint to bring further supply to the market, while also advancing plans to take a stake in the Galleria Luxury Collection retail asset through a joint venture with Mubadala that is scheduled to complete in 2025. A rigorous focus on premium spaces and plans to further develop the island’s commercial offerings will ensure Al Maryah Island remains the destination of choice for firms aiming to expand their presence in a country and region positioned for exceptional growth.

Growing footprint for a successful franchise

Aldar has successfully expanded its footprint into Dubai, focusing on the major themes defining the Emirate’s economic success – growth of the financial services sector, trade and commerce, and an expanding population. Through a blend of development joint ventures, acquisitions, and its develop-to-hold strategy, the company is increasing exposure across the residential, commercial, retail and logistics asset classes. Key initiatives include the strategic joint venture with Dubai Holding to develop three master-planned communities, a logistics partnership with DP World and the acquisition of an office tower to be built in the Dubai International Financial Centre (DIFC); positioning Aldar as the only company that owns commercial assets onshore in Abu Dhabi and Dubai, as well as offshore in the financial centres of both Emirates – ADGM and DIFC.

-

Verdes by Haven

-

Athlon

Positioned for rapid growth in tourism

Ras Al Khaimah continues to play a key role in Aldar’s geographic diversification strategy. To capitalise on the Emirate’s rising prominence as a tourism and recreation hub, the company has redeveloped Al Hamra Mall, positioning it as a premier retail destination, while acquiring and investing in the upgrade of the key hospitality assets of Rixos Bab Al Bahr and DoubleTree by Hilton Resort & Spa Marjan Island. Bringing a new luxury lifestyle offering to the market, Aldar is developing branded residences in collaboration with Nikki Beach.

An integral role in the UAE’s transformation

As a leader in the real estate sector, Aldar remains integral to the UAE’s remarkable economic transformation. The country’s business-friendly agenda is attracting global capital and talent, fueling robust demand for Aldar’s diverse offering – from wellness-inspired communities, premium schools, and world class hospitality to exceptional retail, prime office spaces, and strategically located logistics assets.

As the UAE channels significant investment into rapid development of a knowledge-based

economy, Aldar is committed to playing a leading role in this exciting phase in the country’s

development. We continue to build our presence in our home market Abu Dhabi, while expanding in

Dubai, Ras Al Khaimah and internationally in Egypt and the UK. This expansion has been supported by

a growing ecosystem of partners, which includes Mubadala, Dubai Holding, DP World, Expo City Dubai,

Apollo, Ares, and Carlyle, placing Aldar at the heart of transformation in a number of key sectors

and geographies.

“In 2024, Aldar built on its strong growth momentum, producing exceptional performance while driving strategic initiatives to ensure the company continues to create substantial value for its shareholders and communities long into the future.

Our new 2030 Strategy prioritises customer experience, product excellence, prudent financial management, sustainability and empowering our employees to thrive. Through this strategy, we look forward to delivering accelerated growth in the interests of all stakeholders.

On behalf of Aldar’s Board of Directors, the Executive Management team and all our employees,

I offer our gratitude to His Highness Sheikh Mohamed bin Zayed Al Nahyan, UAE President and Ruler of

Abu Dhabi, and His Highness Sheikh Khaled bin Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi

and Chairman of the Abu Dhabi Executive Council, for their steadfast support and vision, which has

contributed so much to the growth of Aldar and the emirate we call home. I also extend my

appreciation to our customers for their trust in the Aldar brand, and to our employees, whose

dedication and expertise are the foundation of our achievements.

An engine for accelerated value creation

Since embarking on our transformational growth strategy in 2020, we have driven significant scale and diversification across the business, with net profit more than tripling to reach AED 6.5 billion in 2024 and return on equity doubling to over 16%.

Over this timeframe, the Aldar Development platform has scaled new heights. Group sales have increased nearly 10 times to AED 33.6 billion in 2024, and the development backlog has increased 15-fold to close to AED 54.6 billion, providing strong revenue visibility in the coming period.

Aldar’s dominant position in Abu Dhabi, coupled with our expansion into Dubai and Ras Al Khaimah, is deeply entwined with the UAE’s growing stature as an international business and lifestyle destination, while our strategic investments in Egypt and the UK complement and broaden our development proposition. Additionally, Aldar Projects continues to play a pivotal role in delivering the Abu Dhabi Government’s housing and infrastructure projects and now manages a diverse fee-generating portfolio.

In parallel, Aldar Investment’s assets under management have more than doubled to over AED 42

billion, while the platform’s adjusted EBITDA has grown significantly to AED 2.7 billion in 2024.

Our develop to hold (D-HOLD) pipeline of assets is now worth AED 13.3 billion, diversified across

the commercial, retail, residential and logistics asset classes, as well as education and

hospitality.

“Aldar is forging a path of accelerated expansion, reinforcing our position as a regional and increasingly global real estate leader. We continue to execute our growth strategy with precision, leveraging a finely tuned operating model, favourable access to capital, and a relentless focus on operational excellence.

These assets will be delivered progressively over the next four years, contributing significantly to the stable, recurring income streams of the platform. Meanwhile, Aldar Education has grown into a major operator with 31 owned and managed schools, Aldar Estates has become the region’s leading property and facilities management businesses, and Aldar Hospitality is undergoing an AED 1.5 billion repositioning to capitalise on the growth of the UAE’s tourism sector and tap into the global luxury travel market.

Looking ahead, Aldar’s growth journey will accelerate through our newly launched ‘2030

Strategy’, a clear plan to elevate product excellence, signature experiences, and capital

management. We will focus on optimising operations, advancing digital transformation, and forging

strategic partnerships, while pursuing disciplined capital deployment to sustain financial

outperformance. Based on Aldar’s strong track record of delivery and the growth plans of each

business, we have set a bold target to reach AED 20 billion in annual net profit by 2030. In

addition, by targeting a return on equity in excess of 20%, we are reaffirming Aldar’s position as a

growth stock.

The UAE’s strong economic fundamentals provide Aldar with an unmatched growth runway. The government’s business-friendly policy agenda is nurturing investment and entrepreneurialism. The country is attracting strong inflows of high-net-worth individuals, businesses, and visitors with a world-class lifestyle and thriving economy, and Aldar will continue to play an integral part of this success.

In 2025, we look forward to putting the new strategic vision we have outlined into action to create positive impacts for our business, shareholders, partners and communities, reinforced by the continued guidance and support of our Board of Directors Chaired by H.E. Mohamed Khalifa Al Mubarak, to which I would like to express my utmost appreciation and gratitude.

Accelerating growth, achieving scale and diversification

Group revenue rose 62% year on year to AED 23 billion, with EBITDA increasing 51% to AED 7.7 billion, driving a 47% increase in net profit to AED 6.5 billion. The sustained strength of the market and clear visibility of our future earnings pipeline point to this strong momentum continuing into 2025 and beyond.

Aldar Development’s revenue surged 90% year on year to AED 15.7 billion, with EBITDA increasing 75% to AED 4.3 billion, predominately driven by the successful execution of the revenue backlog from new and existing projects. The platform set a fresh record for annual Group sales, which increased by 20% to AED 33.6 billion, supported by 12 launches in the UAE that were met with an exceptional market response that reflects the country’s status as a preferred destination for capital, investment, and residence. A significant feature of this success was the strong demand from overseas and expatriate buyers, who collectively accounted for 78% of total UAE sales, facilitated by Aldar’s digital ecosystem Live Aldar and an expanding network of international brokers. Looking ahead, Aldar Development is focused on delivering its highest ever Group development backlog, which reached AED 54.6 billion by the end of 2024, and further activating its prime landbank through a strong pipeline of development launches in 2025 in the UAE, the UK and Egypt.

“ Through rigorous execution of strategy, Aldar extended its record-setting growth trajectory in 2024, successfully scaling operations across our core businesses and laying the groundwork for the next phase of expansion.

A similarly dynamic performance was achieved by Aldar Investment, which continues to implement a strategy for expansion and diversification. Revenue increased 21% to AED 7 billion in 2024, with adjusted EBITDA up 20% to AED 2.7 billion. This growth was driven by strong occupancy and rental rates, particularly in the commercial and retail segments, a positive impact from acquisitions over the last few years, and solid contributions from our education, estates and hospitality platforms.

Active asset management remains a core strength and differentiator, and the business will continue to deploy talent and investment to create value across our properties, including the new joint ventures with Mubadala to own retail, commercial and logistics assets. The platform is also focused on prudent balance sheet management, and during the year Aldar Investment Properties (“AIP”), the entity that holds the company’s recurring income real estate portfolio, successfully issued its second USD 500 million green sukuk, achieving the tightest credit spread in Aldar’s history at 110 basis points.

Sustainability that drives financial gains

Aldar continues to make solid progress on sustainability, and particularly our target to achieve net zero by 2050, enhancing the environmental and efficiency performance of our development and managed assets. Our focus on sustainable, wellness-inspired communities, is resonating strongly with customers, and the business is prioritising construction of greener and more energy efficient developments. Notably, our Athlon development in Dubai was awarded the UAE’s first LEED Platinum certification for community planning, in recognition of its integration of energy efficiency, water conservation and other sustainability features – serving as a benchmark for sustainable urban development in the region.

We also made significant progress in resource efficiency. Across our investment property portfolio, we continued to implement energy-efficient technologies and expanded the use of renewable energy, reducing our carbon footprint. Our existing properties have been retrofitted to meet stringent sustainability standards, resulting in lower operating costs and improved tenant satisfaction, with LEED certification expanded to 23% of our operational assets. We have strengthened circular economy efforts, recycling 92% of construction waste and diverting a growing volume of waste away from landfill and towards valuable pathways of reuse. Sustainable design is also a key priority, with 98% green concrete used in new developments and 80% of newly designed buildings achieving a 3 Pearl Estidama rating. In supply chain sustainability, 100% of suppliers for contracts above AED 500,000 were screened on sustainability criteria.

Strong financial foundations

While investing in our engines of growth, we have also taken bold steps to optimise our capital structure and foster financial resilience. Aldar concluded three landmark transactions at the ‘PJSC” level in early January 2025 totaling close to USD 4.0 billion that provide long-term support for our growth strategy, and their success underscores our strong standing in the international financial community and investor confidence in the company’s fundamentals.

Firstly, Aldar successfully concluded a USD 1 billion hybrid capital issuance, which was oversubscribed by 3.8 times after attracting a wide cross section of international institutional investors. This transaction marked a number of milestones – the largest conventional hybrid ever issued in the Middle East, and the highest rating and tightest credit spread ever achieved by a corporate hybrid in the CEEMEA region. In the process, Moody’s reaffirmed Aldar’s Baa2 credit rating with a stable outlook and assigned a standalone credit rating of Baa3 to the hybrid notes, reflecting the company’s robust financial position, and the innovative structure of the hybrid issuance, which for ratings purposes is treated as equity and debt in equal measure.

This was closely followed by a USD 2.45 billion sustainability-linked syndicated revolving credit facility, with the participation of 15 leading international and regional financial institutions providing a significant enhancement to Aldar’s liquidity position to over AED 30 billion. We have also reinforced our long-term partnership with Apollo Global Management (‘Apollo’) through a private placement of USD 500 million in subordinated hybrid notes, replacing a land joint venture that was part of Apollo’s initial USD 1.4 billion investment into Aldar in 2022.

Aldar’s strong financial performance in 2024 and the initiatives we have taken to bolster our balance sheet provide solid foundations for the company’s next phase of accelerated growth. In the context of the UAE’s robust macroeconomic fundamentals and a conducive policy environment for business and investment, we see significant opportunity to ramp up the scale of both the development and the investment businesses through a disciplined approach to capital deployment.

Shaping the business to deliver sustainable growth

Aldar’s goal is to drive maximum financial returns for its shareholders by continually growing its portfolio and exploring new opportunities. During 2024, the Group continued to deliver on the objectives set out in its 2020 Strategic Framework, and by year end unveiled a revitalised 2030 Strategy that will foster growth and resilience over the next five years.

Building Thriving Communities and Brighter Futures

Our ambition is to build sustainable places, thriving communities and a brighter, more resilient future for all. This sustainability summary shares highlights from Aldar’s journey towards this vision. We invite you to explore the progress we made in 2024, and to discover even more details in our annual sustainability report.

We are focused on shaping thriving communities and creating sustainable places that integrate climate resilience and resource efficiency into every stage of a building’s lifecycle, accelerating our progress towards Net Zero.

Our vision encompasses a focus on generating societal value through inclusive growth and vibrant, connected neighbourhoods that empower individuals and communities, promote equity, and drive socioeconomic development.

We uphold responsible, ethical business practices and accountability, which serve as the foundation for embedding sustainability across our value chain, providing a safe and inclusive workplace, and positioning Aldar as an employer of choice to create a lasting positive legacy for stakeholders and the industry.