Aldar General News

October 29, 2024

recent group highlights

Q3/9M 2024 Group Highlights

- Strong development sales momentum of AED 24 billion in the first nine months of 2024, up 24% YoY, driven by solid demand for new launches and inventory.

- Three new project launches in Q3: Verdes by Haven in Dubai, The Arthouse on Saadiyat Island and Yas Riva – taking total year-to-date launches to eight.

- Continued growth of overseas and expat resident customers accounting for 76% of UAE sales at the end of September, standing at AED 15.3 billion.

- Increasingly diversified group backlog reaching a record high of AED 48.6 billion and highest-ever UAE backlog of AED 40.5 billion, driving revenue recognition over the next 2-3 years.

- Strategic replenishment of landbank to support future growth in Abu Dhabi as well as overseas with London Square acquiring 3 new sites in Q3, taking year to date site acquisitions in London to 10 plots.

- Aldar Investment revenue reached AED 5 billion for the first nine months of 2024, marking a 24% YoY increase supported by strategic acquisitions made in 2022 and 2023 that are contributing to the bottom line and surpassing expectations.

- Strategic partnership with Mubadala to own and manage assets valued at AED 30 billion in Abu Dhabi, is set to drive significant scale, diversification, and value for the business.

- Continued capital deployment to support develop-to-hold asset pipeline, which now stands at AED 9.35 billion across UAE.

- Strengthened presence in Dubai with entry to commercial sector via 6 Falak acquisition, a Grade A tower set for development adjacent to DIFC, and the recently announced joint venture with Expo City Dubai.

- Ample liquidity to support growth agenda with AED 9.5 billion in free cash and unrestricted cash, and AED 8.4 billion in undrawn committed credit facilities.

aldar group table

Abu Dhabi, 29 October 2024

| Revenue | Gross Profit | EBITDA | Net Profit (after tax)1 | |

|---|---|---|---|---|

| 9M 2024 |

AED 16.5 bn + 69% YoY |

AED 5.7 bn +42% YoY |

AED 5.4 bn +55% YoY |

AED 4.6 bn +52% YoY |

| Q3 2024 |

AED 5.6 bn + 61% YoY |

AED 1.8 bn + 40% YoY |

AED 1.5 bn + 41%YoY |

AED 1.3 bn + 41% YoY |

1 Aldar’s effective tax rate for 9M 2024 stood at 3.9% relating to UAE operations following the introduction of UAE corporate income tax on 1st January 2024. Pre-tax net profit rose 55% to AED 4.8 billion as of 9M 2024 and increased 39% to AED 1.3 billion in Q3 2024.

H.E. MOHAMED KHALIFA AL MUBARAK, CHAIRMAN OF ALDAR PROPERTIES

TALAL AL DHIYEBI, GROUP CHIEF EXECUTIVE OFFICER OF ALDAR

aldar development table

ALDAR DEVELOPMENT

Comprising three segments: Property Development and Sales, focuses on the development and sales of prime properties strategically located in the UAE's most desirable communities. Project Management Services, the dedicated project delivery arm of the Group’s project management businesses; and International, responsible for overseeing property development and sales for both SODIC in Egypt and London Square in the United Kingdom.

| AED million | 9M 2024 | 9M 2023 | % change | Q3 2024 | Q3 2023 | % change |

|---|---|---|---|---|---|---|

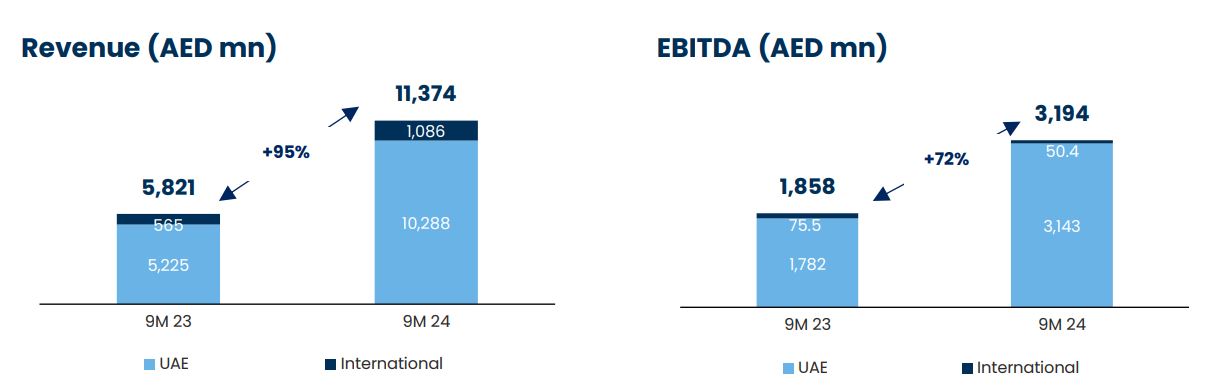

| Revenue | 11,374 | 5,821 | 95% | 3,853 | 1,935 | 99% |

| EBITDA | 3,194 | 1,858 | 72% | 948 | 593 | 60% |

| Group Sales | 23,955 | 19,395 | 24% | 9,939 | 7,819 | 27% |

| UAE sales | 20,232 | 17,040 | 19% | 7,285 | 6,440 | 13% |

Aldar development-text

- Aldar Development’s Q3 2024 revenue surged 99% YoY to AED 3.9 billion with nine-month revenue jumping 95% YoY to AED 11.4 billion and EBITDA increasing 72% to AED 3.2 billion, predominately driven by the successful execution of the revenue backlog from new and existing projects.

- Group sales in Q3 2024 grew 27% YoY reaching a quarterly record of AED 9.9 billion, with nine-month group sales rising 24% to AED 24 billion as Aldar continued to deliver on its sustainable and elevated run rate. This strong sales momentum was driven by the launch of new wellness-inspired luxury developments and positive contributions from Aldar’s international sales network.

- Group revenue backlog reached a record AED 48.6 billion as at the end of September 2024, up from AED 36.8 billion at the end of 2023, providing strong visibility on revenue across UAE and International operations over the next 2-3 years.

- Project management services backlog as at the end of September 2024 was AED 76 billion, with AED 54 billion currently under construction.

UAE

- Total UAE sales in Q3 2024 increased 13% YoY to AED 7.3 billion with nine-month UAE sales rising 19% YoY to AED 20.2 billion, driven by strong demand for both new and existing developments across Abu Dhabi, Dubai, and Ras Al Khaimah. In Q3 2024, Aldar successfully launched three new projects, taking year to date total launches to eight. These launches included Verdes by Haven in Dubai, The Arthouse on Saadiyat Island and Yas Riva – which achieved the highest price per square foot ever realised on Yas Island.

- UAE sales to overseas and expat buyers reached AED 15.3 billion in the first nine months of 2024, accounting for 76% of sales with sales to UAE nationals accounting for AED 4.9 billion, representing 24% of UAE sales.

- UAE revenue backlog as at the end of September 2024 stood at a record AED 40.5 billion up 39% from AED 29.1 billion as at the end of 2023, with an average duration of 31 months, providing significant revenue recognition and strong visibility on revenue over next 2-3 years.

- Cash collections in Q3 2024 stood at AED 2.8 billion, taking the nine-month 2024 total to AED 7.2 billion in line with the ramp up of development projects.

- Escrow cash balances in Q3 2024 reached AED 9.3 billion.

International

SODIC2

- SODIC contributed AED 154 million (EGP 2 billion) in revenue in Q3 2024 and AED 463 million (EGP 5.4 billion) in the first nine months of 2024 to Aldar Development.

- SODIC's sales rose 70% YoY reaching a record AED 2.3 billion (EGP 30.8 billion) in Q3 2024, with nine-month sales of AED 3 billion (EGP 39.6 billion) up by 28% YoY.

- Revenue backlog stood at AED 6.3 billion (EGP 82.2 billion) as at the end of September 2024, with an average duration of 38 months, on the back of the successful Ogami development launch with robust demand supported by cross-selling efforts into the UAE market.

London Square (LSQ)3

- London Square’s contribution to Aldar Development’s revenue was AED 194 million (GBP 41 million) in Q3 2024 and AED 623 million (GBP 133 million) in the first nine months of 2024.

- London Square’s total sales in Q3 2024 reached AED 313 million (GBP 59 million) and AED 709 million (GBP 144 million) in the first nine months of 2024.

- London Square revenue backlog was AED 1.8 billion (GBP 368 million) as at the end of September 2024, with an average duration of 24 months, providing strong earnings visibility on revenue over the next two years.

- Since Aldar's acquisition at the end of 2023, London Square has made significant progress in scaling, integration, and growth. Year-to-date, London Square has completed 10 land acquisitions and launched two developments: Twickenham Green and Twickenham Square.

2 EGP figures stated at the average exchange rate during each quarter (Q3 2024 EGP/AED = 0.08) and quarter end (30 Sep 2024 EGP/AED = 0.08), as applicable

3 GBP figures stated at the average exchange rate during each quarter (Q3 2024 GBP/AED = 5) and quarter end (30 Sep 2024 GBP/AED = 5), as applicable

Copy of aldar development table

ALDAR INVESTMENT 4

Comprising four main segments representing over AED 37 billion of assets under management: Investment Properties houses Aldar’s main asset management business comprising prime real estate assets across retail, residential, commercial, and logistics segments. Aldar Hospitality owns a portfolio of hotels as well as leisure assets principally located in Abu Dhabi and Ras Al Khaimah. Aldar Education is the leading private education provider in Abu Dhabi with 31 owned and managed schools primarily across the UAE. Aldar Estates is the region’s largest integrated property and facilities management platform

| AED million | 9M 2024 | 9M 2023 | % change | Q3 2024 | Q3 2023 | % change |

|---|---|---|---|---|---|---|

| Revenue | 4,965 | 4,005 | 24% | 1,730 | 1,514 | 14% |

| Adjusted EBITDA5 | 1,993 | 1,616 | 23% | 674 | 580 | 16% |

4 Excludes Pivot.

5 Adjusted for fair value movements (excluding amortization of leasehold assets), reversal of impairments and one-off gains/losses on acquisitions

Aldar Investment

- Aldar Investment’s revenue reached AED 1.7 billion in Q3 2024, marking a 14% YoY increase. In the first nine months, revenue grew by 24% to AED 5 billion

- Aldar Investment’s Adj. EBITDA in Q3 2024 was AED 674 million, representing a 16% YoY increase, while nine-month 2024 Adj. EBITDA rose 23% YoY to AED 2 billion. This growth was driven by robust organic operational performance supported by strategic acquisitions made in 2022 and 2023 that are contributing to the bottom line and surpassing expectations

- Investment Properties Adj. EBITDAin the first nine months rose 8% to AED 1.3 billion, driven by higher occupancy levels and rental rates. Occupancy across the portfolio stood at a robust 95% as of 30 September 2024.

- The Residential portfolio is achieving strong renewals and higher rental rates, with 98% occupancy as at the end of September and residential bulk leases remaining healthy at 63%. Due to a one-off gain from the termination of a bulk lease in the prior year, Adj. EBITDA decreased 35% YoY to AED 107 million in Q3 2024 and declined 16% YoY to AED 302 million for the first nine months of 2024. Excluding the one-off gain, Adj. EBITDA for the nine-month period was flat YoY6.

- Retail Adj. EBITDA for the nine-month period increased 4% YoY to AED 359 million, with the portfolio benefiting from a solid occupancy rate of 89%. Yas Mall continues to perform strongly due to its strong appeal and status as a premier shopping and entertainment destination in Abu Dhabi, resulting in a 96% occupancy rate, an 8% YoY rise in tenant sales, and a 16% YoY increase in footfall. Adj. EBITDA in Q3 2024 remained flat YoY at AED 113 million. As part of Aldar’s AED 500 million redevelopment initiative, Al Hamra Mall is now fully operational with the asset contributing to the bottom line, while the redevelopment of Al Jimi Mall is scheduled to complete in H2 2025.

- Commercial Adj. EBITDA in Q3 2024 increased 11% YoY to AED 170 million, with nine-month 2024 Adj. EBITDA rising 26% YoY to AED 549 million, driven by strong demand for Grade A office spaces and increased rental rates. Strong occupancy levels at 97% for the full portfolio as well as key assets including Abu Dhabi Global Market (ADGM) towers at 96%, HQ Building at 100%, Al Maryah Tower at 88%, International Tower at 100%, and 6 Falak at 97%.

- Logistics Adj. EBITDA in Q3 2024 was AED 15 million, a 33% YoY increase, and for the nine-month 2024 period Adj. EBITDA rose 25% YoY to AED 45 million. This strong performance was driven by high occupancy rates, with warehouses at 98% and overall portfolio occupancy at 94%, as well as positive contributions from the acquisition of 7 Central in Dubai. Aldar continues to pursue growth through its partnership with DP World and the expansion of Abu Dhabi Business Hub which is set to be completed by the end of 2024.

- The Hospitality portfolio is undergoing a significant transformation with an AED 1.5 billion investment aimed at introducing iconic brands to the UAE and elevating hotel assets into luxury resort-style properties; this includes several key assets such as Nurai, Eastern Mangroves, Yas Plaza Hotels, and the resort formerly known as Tilal Liwa. Despite the ongoing redevelopment works, the portfolio remains resilient with performance bolstered by key assets in Ras Al Khaimah, which are continuing to exceed expectations, with portfolio occupancy at 71%, Average Daily Rates (ADR) increasing 4% YoY, and revenue per available room (RevPAR) rising 9% YoY. Excluding the impact of assets under development and one-off income recognised during 2023, the portfolio recorded an Adj. EBITDA of AED 32 million in Q3 2024, up 5% YoY, with the first nine months of 2024 Adj. EBITDA reaching AED 154 million, up 12% YoY.

- Aldar Education Adj. EBITDA in Q3 2024 increased 93% YoY to AED 93 million with nine-month 2024 Adj. EBITDA reaching AED 210 million, registering 49% in YoY growth. Excluding the reversal of a provision taken in Q3 2024, nine-month 2024 Adj. EBITDA rose by 40% YoY. The portfolio’s student body now exceeds 36,000 with recent acquisitions stabilising, a 13% growth in new enrollments across operated schools, and tuition fee increases all providing solid contributions to the bottom line. The opening of Yasmina British School’s new campus and the addition of Noya British School in the 2024/25 academic year have increased student capacity to over 52,000 across 12 Aldar-owned and operated schools, and 19 managed schools. Further growth is expected with the opening of an additional greenfield school, Saadiyat British Academy, at the start of the 2025/26 academic year.

- Aldar Estates Adj. EBITDA in Q3 2024 rose 76% YoY to AED 96 million and surged 120% YoY in the first nine months of 2024 to AED 251 million. The strong performance is owed primarily to the series of strategic mergers and acquisitions completed last year, creating the region's leading integrated property and facilities management platform. The enlarged platform now manages 156,000 residential units, over 2 million sqm of gross leasable area and holds contracts valued at more than AED 1.6 billion.

- Aldar continues to execute on its comprehensive investment and partnership programme to deliver diversification, scale, and earnings growth. This comprises a significant develop-to-hold pipeline across retail, commercial, logistics, residential and hospitality assets that has expanded to AED 9.35 billion following the announcement of the Expo City Dubai joint venture in October 2024. These programmes are additive to Aldar’s ongoing acquisition strategy and are expected to significantly boost recurring income streams and long-term capital appreciation

- The four joint ventures created through a strategic partnership with Mubadala bring together AED 30 billion of prime Abu Dhabi real estate. The partnership will create substantial value for Abu Dhabi through a world class retail platform to consolidate the emirate’s premium shopping destinations, the acquisition of sustainable mature residential and commercial income-generating assets in Masdar City, the development of strategically located islands adjacent to Saadiyat Island and Yas Island, and the creation of a logistics park close to Zayed International Airport.

6 Excluding the strata unit disposals and RAK accommodation acquisition, Adj. EBITDA for the nine-month 2024 period increased by 1% YoY.

Corporate Debt

Corporate Updates

- In August 2024, Moody’s reaffirmed Aldar’s Baa2 credit rating and Aldar Investment Properties' Baa1 rating, both with a stable outlook.

- In Q3 2024, Aldar raised AED 2 billion in senior unsecured financing through 5-year bullet revolving credit facilities. This has improved Aldar’s liquidity profile and extended the average maturity of its debt to 5.2 years.

- As of 30 September 2024, Aldar has fully paid down all its secured debt across UAE and UK businesses, reinforcing its financial strength and providing increased access to capital for future opportunities.

- Customer traffic on the World of Aldar digital channel has grown consistently since it launched in Q2 2024. To the end of September, World of Aldar registered 352,000 unique customer visits, 41% of which were international customers.

- The rollout of Live Aldar – a digital platform for customers managing the build process of homes they have bought off plan - is progressing well, with over 50% of active customers interacting with the application since rollout in March 2024. 70% of these customers are using digital as the core channel to onboard themselves, sign sales and purchase agreements, download statements of account, pay service charges, request services and manage their ‘Aftercare’ handover requests.

ESG Highlight

ESG Highlights

As one of the UAE’s leading real estate developers, Aldar has a duty to uphold best practice international ESG standards. ESG is a core pillar of the company’s long-term growth strategy, with strong governance and responsible environmental and social impact integrated into its investment processes and business decisions. Highlights of Aldar’s recent ESG activities include:

- In the first nine months of 2024, Aldar's Emiratisation level reached 43% reflecting the company’s strong focus on developing UAE talent.

- Aldar’s Athlon development in Dubai was awarded the UAE's first LEED (Leadership in Energy and Environmental Design) Platinum certification for community planning due to its focus on sustainability, including energy efficiency, water conservation, and creating a healthy living environment.

- Aldar also achieved LEED certification for a further 11 assets within its portfolio, including six Aldar Education schools receiving LEED Gold certification and five commercial assets receiving LEED Platinum certification. The company aims to complete LEED certification for 900,000 sqm of its portfolio by the end of 2024.

- Aldar partnered with Dubai Cares for its ‘Back to School’ initiative, which resulted in 10,000 essential school kits provided to children from low-income families across the UAE as part of Aldar’s AED 1 million commitment.