Aldar General News

July 29, 2024

recent group highlights

H1 2024 Group Highlights

- Strong development sales momentum of AED 14.0 billion in H1, up 21% YoY, supported by solid demand for new launches and existing inventory.

- Continued strong demand from overseas and resident expat buyers, accounting for AED 10.2 billion, or 79%, of H1 UAE sales.

- Record development backlog of AED 39.0 billion, and highest-ever UAE backlog of AED 33.2 billion, propelling revenue recognition over the next 2-3 years.

- Future growth to be driven continued realization of backlog supported by substantial pipeline of new project launches, while investment in strategic land bank replenishment lays a solid foundation for further activation.

- Strategic entry into Dubai commercial segment through a total commitment of AED 1.8 billion, with development of an iconic office tower development with a net leasable area of 88,000 sqm on Sheikh Zayed Road and acquisition of ‘6 Falak’, a newly built Grade A office building located in Dubai Internet City.

- Strong investment portfolio performance driven by high occupancy levels – particularly on the commercial portfolio – underpinned by favourable market conditions and meaningful contributions from prior-year acquisitions.

- Strategic partnership with DP World to develop a logistics park in Dubai. This forms part of the previously announced AED 1 billion investment commitment towards logistics assets.

- Investment properties platform to transform scale, diversify and deliver earnings growth through strategic capital deployment and asset optimisation.

- Optimized debt structure through the issuance of a second USD 500 million green sukuk, achieving Aldar’s tightest ever credit spread, and the tender buyback of 2025 sukuk.

- Ample liquidity to support growth agenda with AED 3.6 billion in free cash, AED 7.6 billion in undrawn committed credit facilities, and AED 6.2 billion in unrestricted escrow accounts.

aldar group table

Abu Dhabi, UAE: 29 July 2024

| Revenue | Gross Profit | EBITDA | Net Profit (after tax)1 | |

|---|---|---|---|---|

| H1 2024 |

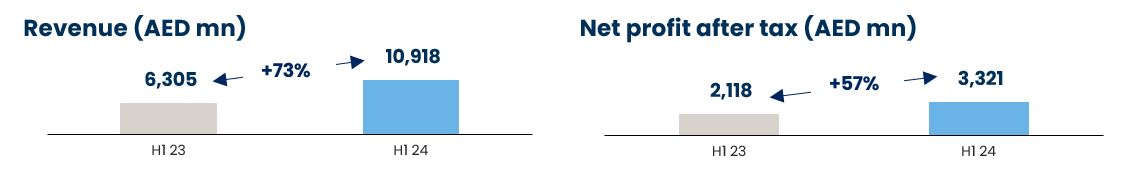

AED 10.9 bn + 73% YoY |

AED 3.9 bn +43% YoY |

AED 3.9 bn +61% YoY |

AED 3.3 bn +57% YoY |

| Q2 2024 |

AED 5.3 bn + 64% YoY |

AED 1.8 bn + 27% YoY |

AED 2.0 bn + 42% YoY |

AED 1.8 bn + 37% YoY |

1 Aldar’s effective tax rate for H1 2024 stood at 4.1% following the introduction of UAE corporate income tax on 1st January 2024. Pre-tax net profit increased 63% to AED 3.5 billion in H1 2024 and increased 42% to AED 1.8 billion in Q2 2024.

H.E. MOHAMED KHALIFA AL MUBARAK, CHAIRMAN OF ALDAR PROPERTIES

TALAL AL DHIYEBI, GROUP CHIEF EXECUTIVE OFFICER OF ALDAR

aldar development table

ALDAR DEVELOPMENT

Comprising three segments: Property Development and Sales, focuses on the development and sales of prime properties strategically located in the UAE's most desirable communities. Project Management Services, the dedicated project delivery arm of the Group’s project management businesses; and International, responsible for overseeing property development and sales for both SODIC in Egypt and London Square in the United Kingdom.

| AED million | H1 2024 | H1 2023 | % change | Q2 2024 | Q2 2023 | % change |

|---|---|---|---|---|---|---|

| Revenue | 7,521 | 3,886 | 94% | 3,634 | 1,969 | 85% |

| EBITDA | 2,246 | 1,266 | 77% | 1,072 | 715 | 50% |

| Group Sales | 14,016 | 11,576 | 21% | 7,703 | 7,027 | 10% |

| UAE sales | 12,947 | 10,600 | 22% | 6,832 | 6,397 | 7% |

Aldar development-text

- Aldar Development’s revenue in Q2 2024 surged 85% YoY to AED 3.6 billion. In H1 2024, revenue jumped 94% YoY to AED 7.5 billion, with EBITDA increasing 77% to AED 2.2 billion, predominately driven by successful execution of the revenue backlog from new and existing projects.

- Group sales in Q2 2024 reached AED 7.7 billion, a 10% YoY growth, buoyed by robust demand for UAE homes predominately from international buyers. As Aldar’s International platforms, SODIC and London Square continue to pursue scale, their contributions are expected to intensify in the coming periods.

- Revenue backlog reached a record AED 39.0 billion as at the end of H1 2024, up from AED 36.8 billion at the end of 2023, providing strong visibility on revenue across UAE and International operations over the next 2-3 years.

- Project management services backlog as at the end of H1 2024 was AED 77.9 billion, with AED 32.9 billion currently under construction.

UAE

- Total UAE sales in Q2 2024 increased 7% YoY to AED 6.8 billion driven by strong demand for both new and existing developments across Abu Dhabi, Dubai, and Ras Al Khaimah. On H1 basis, UAE sales increased 22% to AED 12.9 billion. In Q2 2024, Aldar successfully launched twonew projects – Source Terraces in Abu Dhabi and Athlon in Dubai – taking total H1 2024 launches to five. The company also focused efforts during this period on selling out existing inventory and has accelerated the handover of various projects, including Noya.

- UAE Sales to overseas and expat buyers reached AED 5.6 billion in Q2 2024, accounting for 82% of sales and AED 10.2 billion in H1 2024, making up 79% of the sales in the UAE. Notably, sales to resident expats more than doubled during the first six months of the year compared to the same period a year ago, reflecting the UAE's appeal as an attractive investment and preferred long-term residence destination.

- UAE revenue backlog as at the end of H1 2024 stood at a record AED 33.2 billion with an average duration of 28 months, up from AED 29.1 billion as at the end of 2023.

- Cash collections in Q2 2024 stood at AED 2.4 billion, taking the H1 2024 total to AED 4.4 billion as the company pursues accelerated delivery of projects.

- Escrow cash balances in Q2 2024 reached AED 8.4 billion, of which AED 6.2 billion is classified as unrestricted.

International

SODIC2

- SODIC contributed AED 143 million (EGP 2.4 billion) in revenue in Q2 2024 and AED 309 million (EGP 3.9 billion) in H1 2024 to Aldar Development. Contribution to EBITDA for Q2 2024 was AED 9 million (EGP 119 million) and AED 41 million (EGP 538 million) in H1 2024.

- SODIC’s sales in Q2 were AED 576 million (EGP 7.5 billion) and AED 673 million (EGP 8.8 billion) in H1 2024, while the revenue backlog stood at AED 4.2 billion (EGP 54.4 billion) as at the end of June 2024, with an average duration of 32 months, providing strong earnings visibility on revenue over the next 2-3 years.

London Square (LSQ)3

- LSQ’s contribution to Aldar Development’s revenue was AED 206 million (GBP 44 million) in Q2 2024 and AED 429 million (GBP 92 million) in H1 2024, with total sales in Q2 reaching AED 295 million (GBP 64 million).

- LSQ revenue backlog was AED 1.6 billion (GBP 352 million) as at the end of June, with an average duration of 28 months, providing strong earnings visibility on revenue over the next two years.

- Since being acquired by Aldar in December 2023, LSQ continues to focus on delivering, scale integration and growth. In 2024, LSQ has completed the acquisition of seven land plots and expects to launch its first development project since Aldar’s acquisition in H2 2024.

2 EGP figures stated at the average exchange rate during each quarter (Q2 2024 EGP/AED = 0.077) and quarter end (30 Jun 2024 EGP/AED = 0.076), as applicable

3 GBP figures stated at the average exchange rate during each quarter (Q2 2024 GBP/AED = 4.67) and quarter end (30 Jun 2024 GBP/AED = 4.64), as applicable

Copy of aldar development table

ALDAR INVESTMENT 4

Comprising four main segments representing over AED 37 billion of assets under management: Investment Properties houses Aldar’s main asset management business comprising prime real estate assets across retail, residential, commercial, and logistics segments. Aldar Hospitality owns a portfolio of hotels with over 4,000 keys as well as leisure assets principally located in Abu Dhabi and Ras Al Khaimah. Aldar Education is the leading private education provider in Abu Dhabi with 30 owned and managed schools primarily across the UAE. Aldar Estates is the region’s largest integrated property and facilities management platform

| AED million | H1 2024 | H1 2023 | % change | Q2 2024 | Q2 2023 | % change |

|---|---|---|---|---|---|---|

| Revenue | 3,236 | 2,491 | 30% | 1,606 | 1,244 | 29% |

| Adjusted EBITDA5 | 1,319 | 1,036 | 27% | 626 | 499 | 25% |

4 Excludes Pivot.

5 Adjusted for fair value movements (excluding amortization of leasehold assets), reversal of impairments, an one-off gains/losses on acquisitions

Aldar Investment

- Aldar Investment’s revenue reached AED 1.6 billion in Q2 2024, a 29% YoY increase. For the H1 2024 period, revenue increased 30% to AED 3.2 billion. Adj. EBITDA in Q2 2024 was AED 626 million, increasing 25% YoY, with Adj. EBITDA in H1 2024 rising 27% YoY to AED 1.3 billion driven by robust organic operational performance, the expansion of the Aldar Estates platform, and meaningful bottom-line contributions from prior year acquisitions.

- Investment Properties Adj. EBITDA in Q2 2024 increased 16% YoY to AED 412 million with Adj. EBITDA in H1 at AED 852 million, a 19% YoY increase, primarily driven by higher occupancy levelsnotably from the commercial, logistics, and residential segments and an uptick in leasing rates, as well as meaningful contributions from acquisitions, which continue to positively impact the bottom line. Occupancy across the portfolio stood at a robust 91% as at 30 June 2024.

- Residential Adj. EBITDA increased 6% YoY to AED 102 million in Q2 2024 on the back of improved operational performance due to increased demand for quality residential units. On an H1 basis, Adj. EBITDA remained broadly unchanged compared to the year ago period at AED 194 million. The portfolio is at almost full capacity as at the end of June, with an occupancy rate of 96%, while residential bulk leases remain healthy at 63%.

- Retail Adj. EBITDA increased 6% YoY to AED 122 million in Q2 2024 with a solid 89% portfolio occupancy rate. Adj. EBITDA for the H1 2024 period was up 6% YoY to AED 246 million. Yas Mall continues outperform thanks to its appeal as a premier shopping and entertainment destination in Abu Dhabi. This resulted in a 95% occupancy rate, an 8% YoY rise in tenant sales, and a 16% YoY increase in footfall. Aldar continues to make good progress on its AED 500 million redevelopment plan to replicate Yas Mall’s success through the repositioning of Al Hamra and Al Jimi malls to expand brand offerings and enhance customer experience, with the redevelopment workscompleted in H1 2024 at Al Hamra mall and expected to be completed in H1 2025 at Al Jimi mall.

- Commercial Adj. EBITDA in Q2 2024 increased 21% YoY to AED 169 million driven by strong demand for Grade A office spaces, an increase in rental rates and strong ramp-up of occupancy at Al Maryah Tower, with an occupancy rate of 83% (vs. 50% in Q1 2024; its first operating period.) Adj. EBITDA in H1 2024 was AED 379 million, a 35% YoY increase. The commercial portfolio has a strong occupancy rate as at 30 June 2024 of 97%. The company is expanding its commercial portfolio by making its first entry into the attractive Dubai commercial market. It plans to develop an iconic Grade A office tower that includes a luxury boutique hotel and branded residences on a prime land plot on Sheikh Zayed Road, close to DIFC. Additionally, the company has signed an agreement to acquire a recently handed-over Grade A office building in Dubai Internet City, '6 Falak'.

- Logistics Adj. EBITDA in Q2 2024 was AED 15 million, a 24% YoY increase and for the six-month period was AED 30 million, up 21% YoY, with occupancy of 94%. The platform continues to pursue growth and expansion through an AED 1 billion investment programme – which included the acquisition of ‘7 Central’ – to expand Aldar’s total logistics GLA in the UAE to more than 400,000 sqm. In July, Aldar signed a strategic agreement with DP World to develop a first of its kind mega 144,000 sqm Grade A logistics park within National Industries Park in Dubai. This investment is in line with Aldar’s develop-to-hold operating model, providing it with key access to a strategically located and well-connected logistics hub.

- Hospitality Adj. EBITDA in Q2 2024 increased 8% YoY to AED 71 million and decreased 2% YoY in H1 2024 to AED 178 million, due to one-off income recognised in the same period last year. On a like-for-like basis (excluding one-off recognised in H1 2023) Adj. EBITDA increased by 8%YoY. Occupancy rates reached 73%, while average daily rates (ADR) increased 4% YoY, and revenue per available room (RevPAR) rose 10% YoY. This was further bolstered by positive contributions from acquisitions over the past two years, particularly in Ras Al Khaimah, which continues to surpass expectations.

- Aldar Education Adj. EBITDA in Q2 2024 increased 19% YoY to AED 61 million and in H1 2024 was AED 116 million, registering a 25% YoY growth. The robust performance was driven by solid operational performance with H1 2024 enrolments up 27% YoY for Aldar-owned and operatedschools, and up 3% YoY for Aldar-managed schools. The total student body now exceeds 36,500 across 30 schools made up of 11 owned-and-operated schools and 19 managedschools across Abu Dhabi, Dubai and Northern Emirates. The business is set for further expansion with two new greenfield schools opening at the start of the 2024-2025 academic year and an additional school in the following year.

- Aldar Estates Adj. EBITDA in Q2 2024 surged 175% YoY to AED 84 million and increased 160% YoY in H1 2024 to AED 155 million. The strong performance is owed primarily to the strategic decision to significantly scale this platform through a series of strategic mergers and acquisitions completed last year, creating the region's leading integrated property and facilities management platform, with synergies driving substantial efficiency and value. The enlarged platform now manages 158,000 units across 2 million sqm gross leasable area and holds contracts valued at AED 1.9 billion.

- Aldar is executing its comprehensive investment and partnership programme to deliver diversification, scale, and earnings growth. This includes a develop-to-hold pipeline that has expanded to AED 7.6 billion across retail, commercial, logistics and hospitality assets, as well as a AED 1.35 billion investment in Aldar Education. These programmes are additive to Aldar’s ongoing acquisition strategy and are expected to significantly boost recurring income streams and long-term capital appreciation.

Corporate Debt

Corporate Debt Updates

- In May, Aldar Investment Properties issued its second USD 500 million 10-year green sukuk and tendered to buy back the sukuk maturing in 2025. The issue achieved the tightest credit spread ever priced by Aldar and was four times oversubscribed by regional and international investors. The tender to buy-back the 2025 sukuk enabled Aldar to use part of the proceedsto refinance existing debt and extend its debt maturity profile.

- In Q2 2024, Aldar refinanced LSQ’s existing debt with a new unsecured loan effectively upsizing the loan, achieving better rates and more favourable conditions. This strategic initiative enhances LSQ capital structure to support long-term growth objectives and aligns with Aldar debt policy.

- Year to date, Aldar has secured AED 3 billion in senior unsecured financing. These five-year bullet revolving credit facilities have improved Aldar’s liquidity profile and extended the average maturity of its debt to 5.4 years.

ESG Highlight

ESG Highlights

As one of the UAE’s leading real estate developers, Aldar has a duty to uphold best practice international ESG standards. ESG is a core pillar of the company’s long-term growth strategy, with strong governance and responsible environmental and social impact integrated into its investment processes and business decisions. Highlights of Aldar’s recent ESG activities include:

- During H1 2024, Aldar awarded 34 contracts – all of which were to UAE based contractors – totaling AED 8.5 billion, with AED 3.9 billion re-circulated to the local economy through the National In-Country Value (ICV) programme.

- During the first six months of 2024, Aldar hired 174 Emiratis across its business, with the total number of job opportunities provided to UAE nationals since the launch of the NAFIS programme now standing at 859.

- Aldar received the highest sustainable urban design rating in Abu Dhabi, Estidama 5 Pearl, for The Sustainable City in Yas Island, featuring advanced energy-efficient building designs, water conservation measures, green spaces, and use of eco-friendly materials.

- Aldar signed its second USD 500 million green sukuk issued, as part of its USD 2 billion Trust Certificate Issue Programme established in 2023. Proceeds of the sukuk will be used in accordance with Aldar’s Green Finance Framework.

- Awarded the UAE’s first LEED for Communities: Plan and Design Platinum certification for Athlon, Dubai’s first active living community, in partnership with Dubai Holding. Promoting sustainable living practices and social cohesion, the development also achieved a 2-Star Fitwel rating – the world’s leading health certification system.

- Partnered with Dubai Cares to support 10,000 children from low-income families across the UAE with school kits ahead of the 2024/25 academic year.