Aldar General News

April 29, 2025

recent group highlights

Q1 2025 Group Highlights

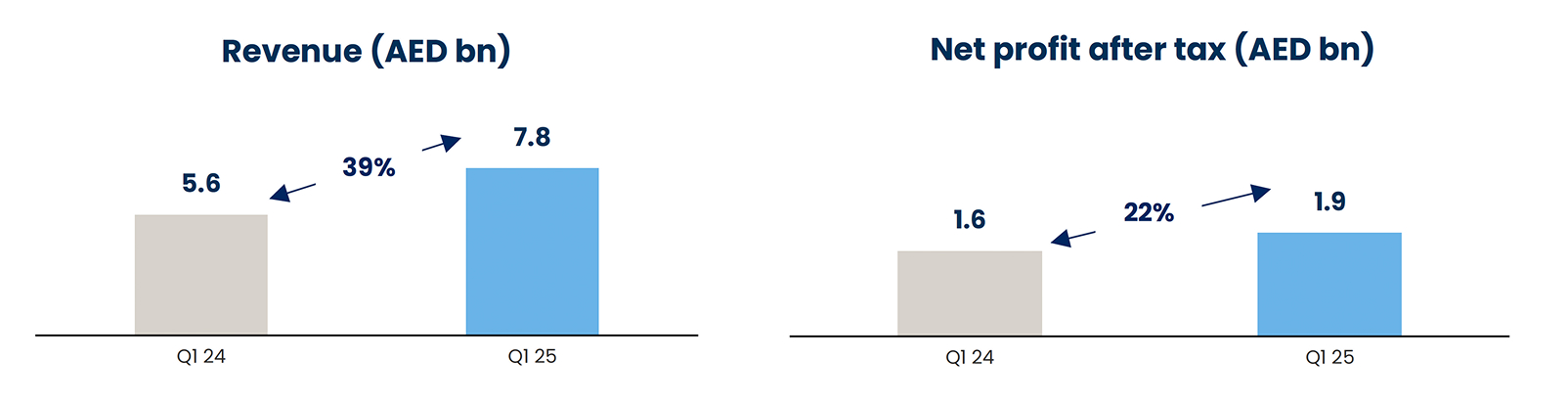

- Net profit before tax rises 33% YoY to AED 2.2 billion with net profit after tax rising 22% YoY to AED 1.9 billion. 1

- Robust development sales of AED 8.9 billion, up 42% YoY driven by strong demand for existing inventory and new launches.

- Strong appeal among international buyers, with UAE sales to overseas and expat resident customers rising to AED 7.4 billion, representing 87% of total UAE sales.

- Increasingly diversified group development backlog has reached a record AED 55.7 billion, with UAE backlog of AED 46.7 billion, driving revenue recognition over the next 2-3 years.

- Aldar Investment delivering on its diversification and growth strategy, with Adj. EBITDA rising 10% YoY to AED 764 million — up 20% excluding gains from disposals and divestments – and assets under management growing to AED 46 billion.

- Aldar strengthened its capital structure and financial resilience, issuing AED 3.7 billion hybrid capital notes and a AED 1.8 billion green sukuk, as well as securing a AED 9 billion syndicated revolving credit facility and a AED 1.8 billion hybrid capital solution from Apollo.

- Earnings per share rises 25% YoY to AED 0.20 on the back of cross-platform earnings growth.

- Strong liquidity position supports prudent growth agenda with AED 10.2 billion in free and unrestricted cash, and AED 19.3 billion in undrawn committed credit facilities as at end of March.

aldar group table

Abu Dhabi, 29 April 2025

| Revenue | Gross Profit | EBITDA | Net Profit (after tax)1 | |

|---|---|---|---|---|

| Q1 2025 |

AED 7.8 bn + 39% YoY |

AED 2.8 bn + 37% YoY |

AED 2.5 bn + 36% YoY |

AED 1.9 bn + 22% YoY |

1 Starting in 2025, the statutory tax rate for Aldar is 15% based on the Domestic Minimum Top-up Tax (DMTT) introduced by the UAE on 1st January 2025, vs. the 9% statutory tax rate in 2024. The effective tax rate for Aldar was 12.64% in Q1 2025 vs 4.06% in Q1 2024. Therefore, year-on-year comparison of net profit is not on a like-for-like basis

H.E. MOHAMED KHALIFA AL MUBARAK, CHAIRMAN OF ALDAR

TALAL AL DHIYEBI, GROUP CHIEF EXECUTIVE OFFICER OF ALDAR

aldar development table

ALDAR DEVELOPMENT

Comprising three segments: Property Development and Sales, focuses on the development and sales of prime properties strategically located in the UAE's most desirable communities. Project Management Services, the dedicated project delivery arm of the Group’s project management businesses; and International, responsible for overseeing property development and sales for both SODIC in Egypt and London Square in the United Kingdom.

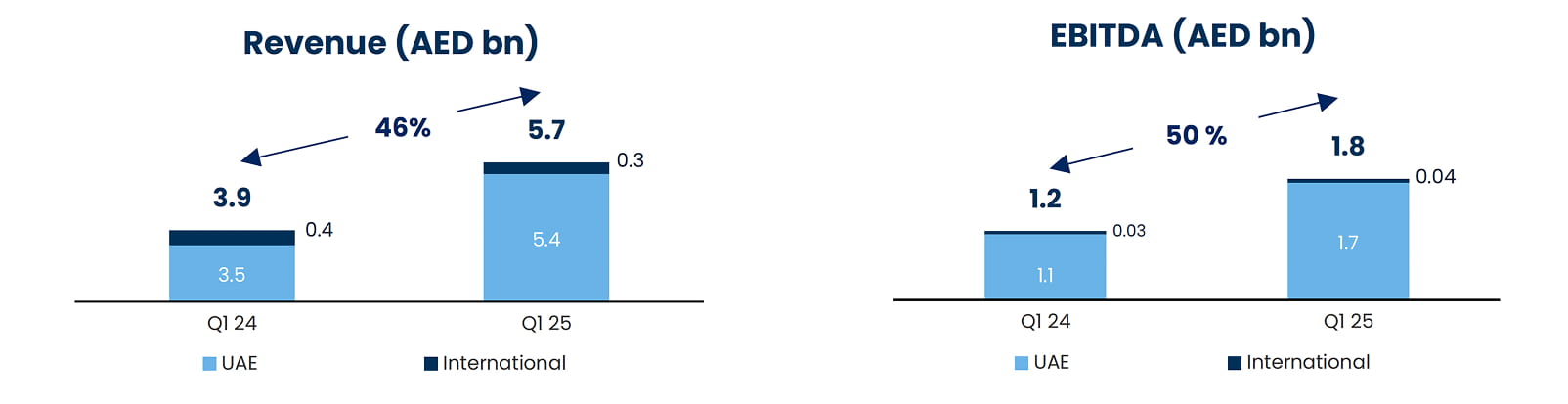

| AED | Q1 2025 | Q1 2024 | YoY |

|---|---|---|---|

| Revenue | 5.7 bn | 3.9 bn | 46% |

| EBITDA | 1.8 bn | 1.2 bn | 50% |

| Group Sales | 8.9 bn | 6.3 bn | 42% |

| UAE sales | 8.4 bn | 6.1 bn | 38% |

Aldar development-text

- Aldar Development’s revenue increased 46% YoY to AED 5.7 billion, while EBITDA rose 50% to AED 1.8 billion driven by recognition of a sizeable backlog, alongside strong sales from new launches and existing inventory supported by sustained international demand.

- Group sales rose 42% to AED 8.9 billion maintaining a high and sustainable run rate. Growth was driven by sales of existing inventory and new launches predominantly in the UAE, supported by an expanding global sales network and strong domestic demand.

- Group revenue backlog reached a record AED 55.7 billion at the end of March 2025, up from AED 54.6 billion at the end of December 2024. This backlog provides strong visibility on UAE and International revenue over the next 2-3 years.

- Project management services backlog at end March 2025 was AED 88.7 billion, with AED 49.5 billion currently under construction, reflecting the strong pipeline of government investment in infrastructure and housing. The platform currently manages a large portfolio of projects at various stages of development for both the Government of Abu Dhabi and Aldar.

UAE

- Total UAE sales increased 38% YoY to AED 8.4 billion driven by strong demand for both new launches and existing developments. Aldar launched two new projects in Q1 2025: Manarat Living III on Saadiyat Island; and The Wilds in Dubai, the third development under a joint venture with Dubai Holding.

- UAE sales to overseas and expatriate buyers increased to AED 7.4 billion, representing 87% of total UAE sales.

- UAE revenue backlog at the end of March 2025 stood at a record AED 46.7 billion, up from AED 45.9 billion at the end of December 2024. With an average duration of 29 months, it provides significant visibility on revenue over the next 2-3 years.

- Cash collections remain strong totalling AED 3.6 billion as the company pursues accelerated delivery of projects.

International

SODIC2

- SODIC contributed AED 172 million (EGP 2.4 billion) in revenue to Aldar Development.

- SODIC’s sales totalled AED 228 million (EGP 3.1 billion), representing a 135% YoY increase in AED terms, and a 150% increase in EGP terms.

- Revenue backlog reached AED 6.3 billion (EGP 87.4 billion) at the end of March 2025, with an average duration of 33 months, on the back of the successful launch of Ogami in the second half of 2024 and strong cross-selling into the UAE market.

London Square (LSQ)3

- London Square’s contribution to Aldar Development’s revenue was AED 135 million (GBP 29 million).

- London Square sales increased 160% YoY in AED terms to AED 263 million (GBP 55 million).

- London Square revenue backlog rose to AED 2.6 billion (GBP 550 million) at the end of March 2025, with an average duration of 29 months, providing strong visibility on revenue over the next 2-3 years.

- Since Aldar's acquisition of London Square at the end of 2023, the company has successfully integrated into Aldar’s international sales network and has made significant progress toward achieving scale and growth. Since the start of 2024 and as of the end of Q1 2025, London Square completed 14 land acquisitions and launched five developments including Earlsfield, Twickenham Green, Twickenham Square, Nine Elms ‘Ascenta Collection’ and Westminster Tower. The platform is set to see accelerated growth in 2025, underpinned by a healthy pipeline and busy development launch calendar.

2 EGP figures stated at the average exchange rate during quarter end (Q1 2025 EGP/AED = 0.073) as applicable. Spot rate as of 31 March 2025 (EGP/AED = 0.073)

3 GBP figures stated at the average exchange rate during quarter end (Q1 2025 GBP/AED = 4.74) as applicable. Spot rate as of 31 March 2025 (GBP/AED = 4.75)

Copy of aldar development table

ALDAR INVESTMENT 4

Comprising four main segments representing over AED 46 billion of assets under management (AUM): Investment Properties houses Aldar’s main asset management business comprising prime real estate assets across retail, residential, commercial, and logistics segments. Aldar Hospitality owns a portfolio of hotels as well as leisure assets principally located in Abu Dhabi and Ras Al Khaimah. Aldar Education is the leading private education provider in Abu Dhabi with 31 owned and managed schools primarily across the UAE. Aldar Estates is the region’s largest integrated property and facilities management platform.

| AED | Q1 2025 | Q1 2024 | YoY |

|---|---|---|---|

| Revenue | 1,871 mn | 1,630 mn | 15% |

| Adj. EBITDA5 | 764 mn | 693 mn | 10% |

4 Excludes Pivot.

5 Adjusted for fair value movements (excluding amortization of leasehold assets), recognition/reversal of impairments and one-off gains/losses on acquisitions

Aldar Investment

- Aldar Investment’s revenue increased 15% to AED 1.9 billion while Adj. EBITDA rose 10% YoY to AED 764 million. Excluding gains from disposals and divestments, the platform’s Adj. EBITDA rose 20%. High occupancy and strong rental growth across the core investment portfolio underpinned solid performance, further supported by strategic acquisitions over the past two years, including Masdar City assets, which drove the platform’s assets under management to AED 46 billion.

- Investment Properties Adj. EBITDA increased 13% to AED 498 million, supported by active asset management, portfolio expansion, and strong UAE macroeconomic fundamentals that have driven demand and rental growth across asset classes. Portfolio occupancy stood at 96% as at end of March. Aldar’s develop-to-hold pipeline, valued at AED 13.3 billion, is set to drive further scale, diversification, and earnings growth across the portfolio in the next three years.

- Commercial Adj. EBITDA increased 1% to AED 212 million, however excluding one-off gains from disposals in Q1 2024, Adj. EBITDA grew 36% driven by overperformance across the portfolio and strong contributions from Masdar City assets. Demand for Grade A office space continues to fuel rental growth, with portfolio occupancy holding strong at 98%. Key assets remain highly occupied: Abu Dhabi Global Market (ADGM) Towers at 99%, International Tower at 100%, Al Maryah Tower at 91%, 6 Falak at 97%, and Masdar at 100%. The platform is focused on expanding Grade A supply through active execution of the develop-to-hold pipeline to meet sustained demand.

- Residential Adj. EBITDA rose 43% to AED 132 million driven by the strong contribution from Masdar City assets, 5% increase in rental rates and 98% occupancy across the broader portfolio. Further growth is expected through the develop-to-hold pipeline, including the Expo City joint venture, and the recycling of strata sales income into high-yielding income-generating assets.

- Retail Adj. EBITDA increased 11% YoY to AED 138 million, driven by higher rents and occupancy levels, which stands at 97%6 underscoring the portfolio’s resilience amid ongoing re-development. Yas Mall continues to lead with 98% occupancy, a 14% rise in tenant sales, and a 16% increase in footfall. Al Hamra Mall reached 97% occupancy following its recent redevelopment, while Al Jimi Mall is set to complete its upgrade in H2 2025. The platform’s growth momentum is set to continue, driven by contributions from the develop-to-hold pipeline as well as the AED 9 billion retail platform comprising Yas Mall and The Galleria Luxury Collection being consolidated under the Mubadala joint venture with completion expected in H2 2025.

- Logistics Adj. EBITDA rose 12% YoY to AED 17 million supported by the portfolio’s occupancy reaching 91%7. Growth momentum is set to accelerate with the expansion of Abu Dhabi Business Hub and the strategic partnership with DP World to develop a logistics park in Dubai. In the near term, additional scale will be driven by the develop-to-hold pipeline, while long-term growth will be anchored by the Al Falah logistics hub under the Mubadala joint venture.

- Commercial Adj. EBITDA increased 1% to AED 212 million, however excluding one-off gains from disposals in Q1 2024, Adj. EBITDA grew 36% driven by overperformance across the portfolio and strong contributions from Masdar City assets. Demand for Grade A office space continues to fuel rental growth, with portfolio occupancy holding strong at 98%. Key assets remain highly occupied: Abu Dhabi Global Market (ADGM) Towers at 99%, International Tower at 100%, Al Maryah Tower at 91%, 6 Falak at 97%, and Masdar at 100%. The platform is focused on expanding Grade A supply through active execution of the develop-to-hold pipeline to meet sustained demand.

- The Hospitality portfolio occupancy stands at 71%, with stable revenue per available room (RevPAR) and average daily rates (ADR) rising 10% YoY. EBITDA declined 14% YoY to AED 92 million, reflecting the interim impact of Aldar’s AED 1.5 billion transformation programme, which saw several assets partially or fully offline for upgrades and repositioning. As part of this programme, Aldhafra Resort, a luxury desert retreat in Liwa, commenced operations in March 2025 under InterContinental Hotels Group’s (IHG) Vignette Collection.

- Aldar Education Adj. EBITDA rose 13% to AED 62 million, driven by strong organic growth, with a 13% increase in enrolment across owned and operated schools and a 3% fee uplift in most operated schools. Total enrolment has reached 37,000, with further scale expected from the upcoming opening of Yasmina American Academy in Khalifa City and a new campus for Muna British School in Saadiyat Lagoons in 2025-2026 academic year, alongside multiple growth levers spanning organic, inorganic, and greenfield developments.

- Aldar Estates Adj. EBITDA rose 27% YoY to AED 90 million driven by an increase in the number of projects across facilities management and integrated community services.

6 Including Remal Mall (a non-core asset), the retail portfolio occupancy stands at 90%.

7 Excluding the newly launched phase 4, the logistics portfolio occupancy stands at 96%.

Corporate Debt

Group & Corporate Updates

- Moody’s reaffirmed Aldar Properties’ Baa2/Stable and Aldar Investment Properties’ Baa1/Stable credit ratings.

- During the quarter, Aldar strengthened its liquidity and capital structure, raising AED 16.3 billion through a series of strategic transactions: AED 9 billion (USD 2.45 billion) sustainability-linked revolving credit facility, AED 3.7 billion (USD 1 billion) hybrid capital notes, AED 1.8 billion (USD 0.5 billion) private hybrid notes with Apollo, and AED 1.8 billion (USD 0.5 billion) green sukuk. These transactions were executed at record low credit spreads, highlighting investor confidence.

- Aldar welcomed 1 million unique visitors across its digital platforms, a 20% YoY increase from Q1 2024, reflecting stronger customer engagement.

- The Live Aldar App has now fully digitized customer onboarding, KYC, and the digital signing of Sales & Purchase Agreements. The Wilds, launched during Q1, saw 97.5% of sales agreements signed digitally.

- The School Life Management system at Aldar Education recorded over 77,000 unique parent sessions, with users actively managing enrolments, payments, term reports, and day-to-day admin tasks, reflecting growing digital maturity in the education vertical.

- In line with the company’s strategy to instil a hospitality mindset across the organization, Aldar launched the Customer Experience Academy during Q1, with plans to train more than 30,000 direct and indirect employees over the coming years.

ESG Highlight

ESG Highlights

As one of the UAE’s leading real estate developers, Aldar has a duty to uphold best practice international ESG standards. ESG is a core pillar of the company’s long-term growth strategy, with strong governance and responsible environmental and social impact integrated into its investment processes and business decisions. Highlights of Aldar’s recent ESG activities include:

- Aldar has reached its 2026 Emiratisation target ahead of schedule. More than 1,000 job opportunities have been created for UAE nationals since 2021, with Emiratis now representing 43.5% of the Group’s employee base.

- In line with the UAE’s ‘Year of Community’ in 2025, Aldar is rolling out a number of initiatives to play a key role in the nation’s socio-economic development. These initiatives - which have benefitted 100,000 individuals to date – will build on Aldar’s existing stream of initiatives across community development, inclusion, education, and humanitarian efforts.

- Aldar contributed AED 500,000 and 111 laptops to The Digital School’s “Bring Your Own Device” initiative, supporting global access to education.

- Aldar achieved an Energy Use Intensity (EUI) improvement of 32% by design against the ASHRAE 2007 baseline. The company has also reduced embodied carbon in construction materials by 20% compared to business-as-usual levels and recycled 96% of construction waste.

- Launched in Q1 2025, The Wilds became the first community in the UAE to achieve both LEED platinum and a 3-star Fitwel rating – the highest category available across these globally recognised certifications.